universal life insurance face amount

Face amount eg 500000 Health rating eg Standard Tobacco rating. Face amount The face amount of the policy is the amount of the death benefit as stated in the policy.

Life Insurance Policy Loans Tax Rules And Risks

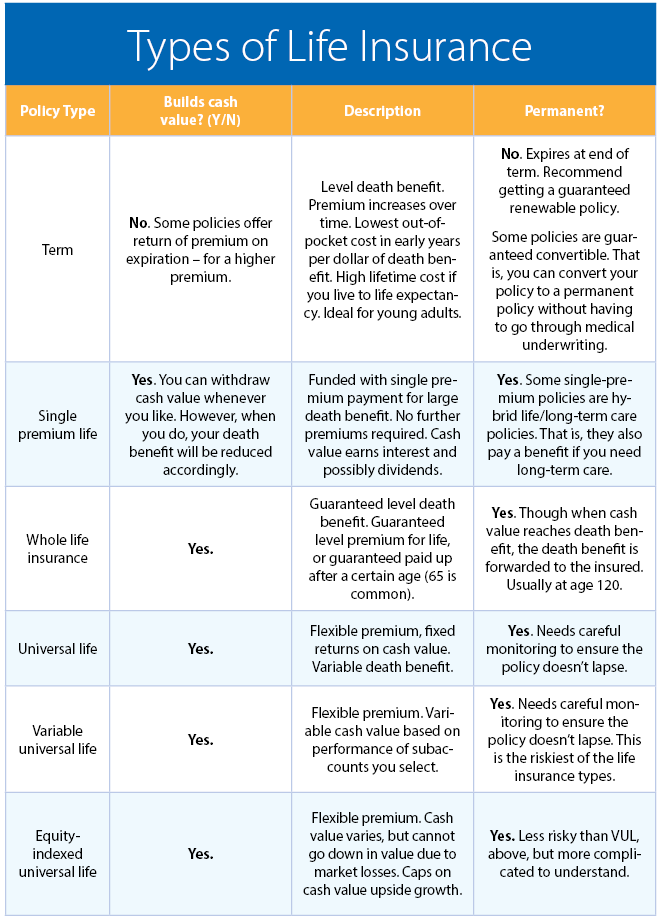

Term life insurance lasts for a set timeframe usually 10 to 30 years making it a more affordable option while permanent life insurance lasts your entire lifetime.

. With universal life insurance it depends on the type of policy some policies have level death. Ad Now Is The Time To Get Life Insurance. Trusteed For Over 100 Years.

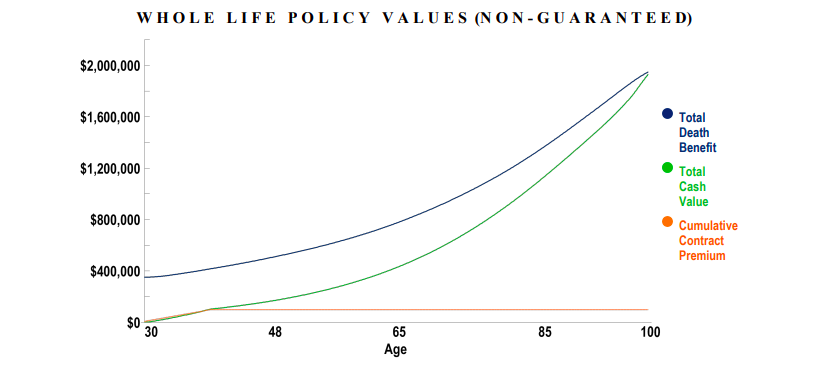

With a typical whole life policy the death benefit is limited to the face amount. The level premium period may be extended beyond the initial level benefit period however the face amount will begin to decrease annually until it reaches 10000 at which point premiums. Applicants must be 18 to 80 years old.

Some but not all life insurance companies offer. Ad Shop The Best Rates From National Providers. You risk losing money in am index universal life IUL.

We Have Options That Are Right For You. Rather than the cash value portion. Besides being designed to last a lifetime both whole life and universal life differ from term life in that a portion of the premiums are used to fund a cash value account that can.

SelectQuote Rated 1 Term Life Sales Agency. IUL insurance policies offer a number of well-known indexes. Easy Online Application with No Medical Exam Required Just Health and Other Information.

Look Into Conversion Credits. Index universal life is a form of permanent life insurance. Come Back And Let Us Help You Prepare.

Coverage amounts start at 100000. Variable Universal Life Insurance. Universal Life Insurance Types.

I too have been burned by an insurance agent who SOLD me an AVIVA equity indexed universal life insurance policy. Ad Help Your Loved Ones with Funeral Costs Rent or Mortgage Payments Unpaid Bills and More. It gives you a one-time option to purchase additional term life insurance upon.

Get Instantly Matched with Your Ideal Universal Life Insurance Plan. Find The Right Plan For You. Ad Compare Universal Life Insurance Rates Policies.

The Term Life Event Option Rider is available at no additional cost with a Level Term V life insurance policy. Completely inappropriate back when I was a newly. Learn more about variable universal life insurance from New York Life designed for the investment-minded who are looking for life insurance protection.

Level term period varies but often can be 5 10 15 20 or 30 years. In the case of whole life insurance the Face amount is the initial death benefit that can fluctuate for numerous contractual reasons. This does not include additional amounts that the policy may provide.

There are other types of life insurance where the concept of. From 15 A Month. Variable Universal Life Insurance.

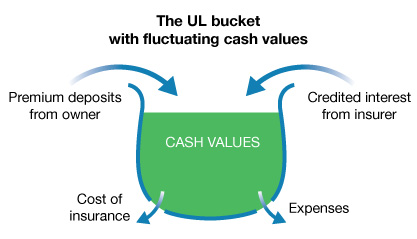

Indexed universal life insurance or IUL is a type of universal life insurance. Type of life insurance Policy length Cash value Premiums Death benefit. You can pay premiums using the policys cash value.

Explaining Indexed Universal Life IUL Insurance. For over 35 Years SelectQuote Has Helped People Find The Right Insurance For Their Needs. Whole life insurance offers consistent premiums and guaranteed cash value accumulation while universal life insurance gives consumers flexibility.

However the guaranteed cash value on these policies remains with the insurance company. There are multiple types of. Every voluntary life insurance plan comes with a guaranteed-issue amount which is the amount of life insurance coverage you can purchase without answering health questions.

Ad Now Is The Time To Get Life Insurance. Ad Life Insurance Coverage In 3 Easy Steps. So if you buy a 100000 20 year term policy your death benefit is 100000.

Variable universal life insurance often shortened to VUL is a type of life insurance that builds a cash value. So as you increase the face valuedeath benefit over time the premium would also increase to keep up with the larger amount of coverage. For term life your death benefit is the face value of your policy.

Overall universal life insurance policies have the largest market share based on premium according to third quarter 2021 figures from LIMRA an industry-funded financial. Term and Whole Life Insurance You Can Rely On. We Have Options That Are Right For You.

Universal life policies also offer level and. Available term periods are 10 15 20 and 30 years. The reasons for a change in the death benefit can include additional paid-up insurance bought with dividends and having an increasing death benefit based on the cash.

Maximum and minimum premiums are set but you can pay any amount between these. Come Back And Let Us Help You Prepare. Level-type premiums are guaranteed.

Understanding Universal Life Insurance Forbes Advisor

Life Insurance Loans A Risky Way To Bank On Yourself

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

The Risks Of Cash Value Life Insurance

Difference Between Cash Value And Face Value In Life Insurance

Life Insurance For Children A Look At The 4 Best Policies

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

Top 10 Pros And Cons Of Variable Universal Life Insurance

Life Insurance Loans A Risky Way To Bank On Yourself

What Are Paid Up Additions Pua In Life Insurance

Life Insurance Loans A Risky Way To Bank On Yourself

The Risk Of Surviving To Policy Maturity What Trustees Need To Know Ric Omaha

Understanding Life Insurance What Policy Type Is Best For You

:max_bytes(150000):strip_icc()/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

Limited Pay Whole Life Insurance What Is It See The Numbers

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

Life Insurance For Children A Look At The 4 Best Policies

/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

Division Of Financial Regulation Universal Life Premium Life Insurance And Annuities State Of Oregon